Fascination About Cfo Company Vancouver

Wiki Article

Facts About Pivot Advantage Accounting And Advisory Inc. In Vancouver Uncovered

Table of ContentsNot known Facts About Vancouver Accounting FirmMore About Vancouver Accounting FirmSome Ideas on Tax Consultant Vancouver You Need To KnowThe Main Principles Of Outsourced Cfo Services The Cfo Company Vancouver DiariesThe Ultimate Guide To Vancouver Accounting Firm

Right here are some benefits to employing an accountant over an accountant: An accountant can offer you a detailed view of your business's financial state, together with techniques and also recommendations for making financial decisions. Bookkeepers are just liable for taping financial transactions. Accounting professionals are called for to finish more schooling, accreditations and job experience than bookkeepers.

It can be challenging to gauge the suitable time to hire an audit professional or accountant or to establish if you need one at all. While lots of local business hire an accounting professional as a professional, you have numerous options for handling financial tasks. Some tiny organization owners do their own bookkeeping on software application their accounting professional suggests or makes use of, offering it to the accounting professional on a weekly, monthly or quarterly basis for action.

It might take some history study to discover an appropriate accountant because, unlike accountants, they are not needed to hold an expert certification. A solid recommendation from a relied on colleague or years of experience are essential factors when employing a bookkeeper. Are you still not certain if you need to hire somebody to aid with your books? Right here are 3 circumstances that show it's time to work with a financial professional: If your tax obligations have actually come to be also complicated to handle by yourself, with multiple revenue streams, foreign financial investments, several reductions or other factors to consider, it's time to hire an accounting professional.

Getting My Tax Consultant Vancouver To Work

For local business, adept cash money administration is an essential aspect of survival and growth, so it's important to collaborate with a monetary specialist from the beginning. If you like to go it alone, take into consideration starting with accountancy software program and also maintaining your books diligently approximately day. In this way, should you need to employ a specialist down the line, they will certainly have exposure into the complete financial history of your business.

Some resource meetings were carried out for a previous version of this write-up.

The 6-Minute Rule for Vancouver Accounting Firm

When it pertains to the ins as well as website here outs of taxes, accounting as well as money, however, it never injures to have a seasoned professional to turn to for advice. A growing number of accounting professionals are likewise caring for things such as cash money circulation forecasts, invoicing and human resources. Inevitably, much of them are handling CFO-like functions.Small company proprietors can anticipate their accountants to aid with: Picking the service structure that's right for you is essential. It affects just how much you pay in tax obligations, the documentation you need to file and also your personal liability. If you're seeking to transform to a different organization framework, it can result in tax obligation effects and also various other problems.

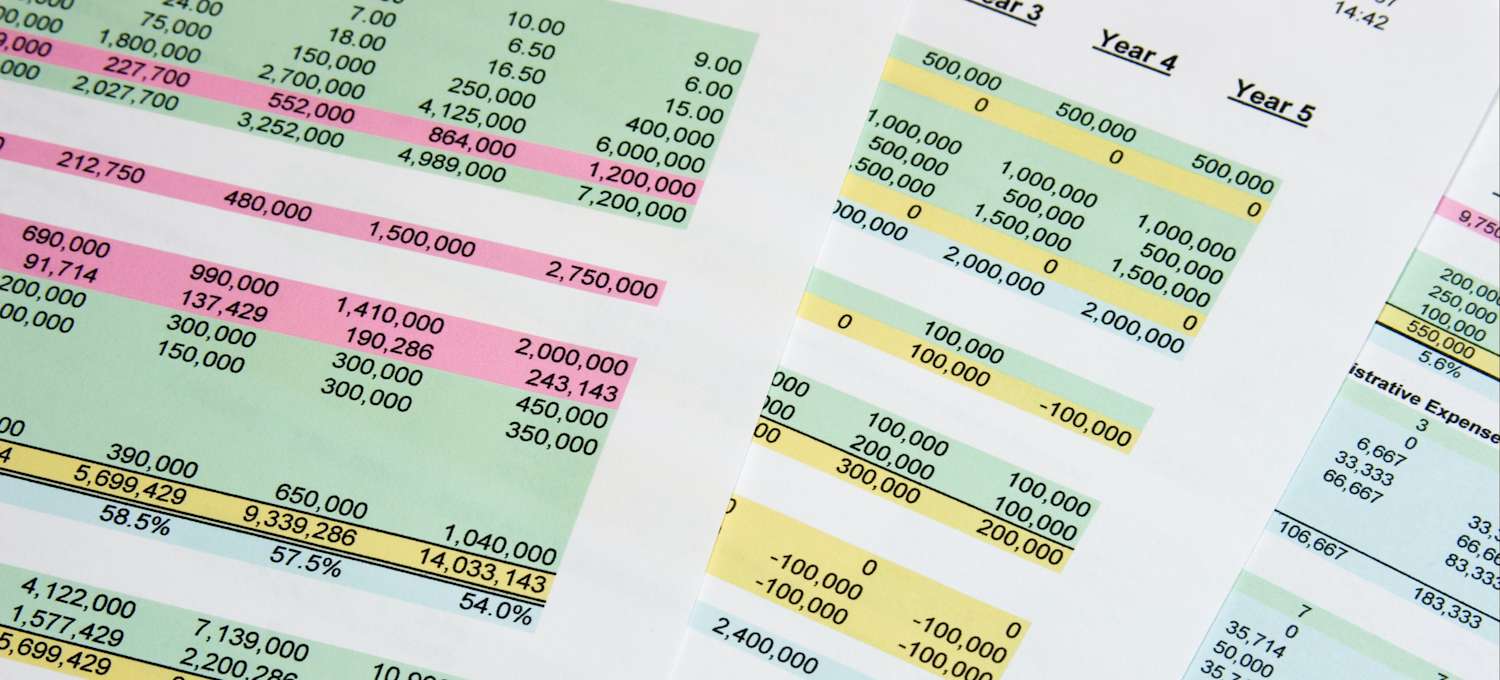

Even companies that coincide dimension and sector pay really different quantities for bookkeeping. Before we enter into buck figures, allow's speak about the expenditures that enter into little service accounting. Overhead expenses are expenses that do not directly turn right into an earnings. These prices do not transform into cash, they are needed for running your organization.

About Tax Accountant In Vancouver, Bc

The ordinary cost of bookkeeping services for tiny organization differs for each and every distinct circumstance. Because bookkeepers do less-involved tasks, their rates are commonly cheaper than accounting professionals. Your monetary service charge relies on the work you require to be done. The typical regular monthly bookkeeping costs for a small company will certainly climb as you add more solutions and the jobs obtain tougher.You can videotape transactions and also procedure pay-roll making use of on the internet software program. Software program remedies come in all shapes and also dimensions.

:max_bytes(150000):strip_icc()/GettyImages-1126511626-72ceb797e9664d05bcb2f7e0a8914b8b.jpg)

What Does Vancouver Tax Accounting Company Mean?

If the accountant you're a brand-new service proprietor, don't neglect to factor accountancy prices into your budget plan. Administrative expenses and accountant charges aren't the only bookkeeping expenses.Your ability to lead workers, serve clients, and also choose can endure. Your time is additionally useful as well as need to be considered when taking a look at accounting costs. The moment invested in bookkeeping tasks does not produce revenue. The much less time you invest on accounting as well as tax obligations, the more time you need to expand your service.

This is not planned as legal advice; for more details, please go here..

Not known Incorrect Statements About Cfo Company Vancouver

Report this wiki page